Education Department Student Loans: Elimination and Reform – What We Know

Title: Grad School Just Got a Whole Lot More Real

The US Department of Education just dropped a financial neutron bomb on graduate programs. Under the One Big Beautiful Bill Act (OBBBA), the Grad PLUS program is gone, and loan limits are about to become a harsh reality. No more borrowing your way to that PhD without a serious financial reckoning.

The End of the Blank Check Era

For years, Grad PLUS let students borrow up to the cost of attendance. Translation: universities could jack up tuition, knowing Uncle Sam would foot the bill. It was a perverse incentive system, and frankly, it's shocking it lasted this long. Now, starting July 2026, grad students are capped at $20,500 per year, with a $100,000 lifetime max. Professional students (think law, medicine) get a bit more—$50,000 annually, $200,000 total, according to the press release. US Education Department finalizes major student loan reforms, capping graduate borrowing and simplifying repayment.

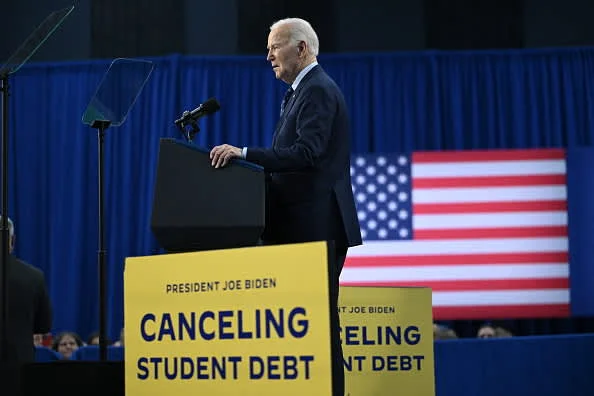

Under Secretary of Education Nicholas Kent calls it "transformative," claiming it will "hold universities accountable" and "put significant downward pressure on the cost of tuition." Bold words. The question is, will the data back it up?

The RISE Committee, after months of meetings, settled on these changes. They reviewed 17 regulatory provisions, including the new Repayment Assistance Plan (RAP). The Department claims to have refined its proposals based on committee feedback. (I've looked at hundreds of these regulatory changes, and "refined" often means "we tweaked the wording to sound better.")

The Department held a virtual public hearing back in August to gather feedback. Public engagement is mandated, supposedly ensuring these changes reflect real-world concerns. But how much does a virtual hearing really influence policy when billions of dollars are at stake?

The Tuition Game: Will It Change?

The core argument is that capping loans will force universities to lower tuition. The logic is simple: if students can't borrow as much, they won't be able to afford inflated tuition rates. Demand will drop, and universities will have to adjust.

But will they?

Universities are masters of creative accounting. They can offer more "merit-based" scholarships (which are really just discounts to attract top students) while quietly raising tuition for everyone else. They can increase fees for "services" (like mandatory health insurance) to offset the loss of loan revenue. The game is complex, and universities have had decades to refine their strategies.

Here's the part I find genuinely puzzling: the Department is betting on tuition decreasing. That's a big assumption. A more likely scenario is that universities will shift their focus to attracting wealthier students who don't need to borrow as much. This could exacerbate existing inequalities in higher education access.

The other risk? Shifting the burden to the states. State schools have always struggled for funding. If Universities can't jack up tuition, will they just ask for more money from the state, thus shifting the burden onto taxpayers?

The Accountability Mirage

Kent claims these reforms will hold universities "accountable for outcomes." But what does that even mean? Will the Department track graduates' employment rates and salaries? Will they penalize programs with low job placement rates? Details on how this "accountability" will be enforced remain scarce.

The OBBBA aims to create a system that balances access with financial sustainability. But balancing act implies tradeoffs. If access decreases, is that an acceptable price to pay for sustainability? And who gets to decide that?

A Sea Change... Or a Drop in the Bucket?

These reforms are undoubtedly a step in the right direction. The Grad PLUS program was a mess, and capping loans is a necessary correction. But let's not pretend this is a silver bullet. Universities are incredibly resilient institutions, and they will adapt to these changes in ways we can't yet predict. Whether this is a "sea change," as Kent claims, or just a drop in the bucket remains to be seen. The data, as always, will tell the real story.

-

The Juan Gabriel 'Alive' Hoax: Deconstructing the Latest 'Proof'

So,JuanGabrielisaliveagain.I...

-

Jeff Bezos: His Net Worth, His Love Life, and Why We're All Obsessed

So,JeffBezoshasdescendedfrom...

-

Zcash's Sudden Price Surge: Analyzing the Catalysts and Its Future Outlook

Zcash'sViolentRally:Deconstruct...

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

Registered Investment Advisor (RIA): Defining the Role, Services, and Fee Structures

TheQuietRuleChangeThatWillRe...

- Search

- Recently Published

-

- Cidara Therapeutics: Stock, News, & The Usual Spin?

- ANyONe Protocol: What the hell is it, and is it even real?

- BMO: The Bank, The Stadium, The Cartoon, and Why You Should Care

- BBAI Stock: The Investment Case vs. The Current Data

- CoreWeave's Stock Nosedive: What They're Not Telling You

- IRS Relief Payment: Status, Timing, and What the Data Shows

- Zcash's "Historic Surge": Hayes is Hyping It?

- BMO: What is it and Where Can I Find One?

- Avelo Airlines: FAA Cuts and the Lakeland Linder Opportunity

- SpaceX Launch Today: What Happened and Launch Time Details

- Tag list

-

- carbon trading (2)

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (29)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (5)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Stablecoin (3)

- Digital Assets (3)

- PENGU (3)

- Plasma (5)

- Zcash (6)

- Aster (4)

- investment advisor (4)

- crypto exchange binance (3)

- SX Network (3)